How to earn passive income from holding Cryptocurrencies

Crypto Income

How to earn passive income from holding Cryptocurrencies. There is a lot of reason to not just hold cryptocurrencies but also earn passive income through it. If you are a cryptocurrency investor, you will be aware of the term HODL. It simply means to hold your cryptocurrency for the long term rather than sell when it is all-time high. Now holding can be a bit worry for some as the volatile cryptocurrency can shed as much as 50-60% or more value in seconds or minutes.

Today, let us see how holding cryptocurrency in your wallet can help you earn passive income. There is some easy risk-free as well risky ways to earn.

Staking

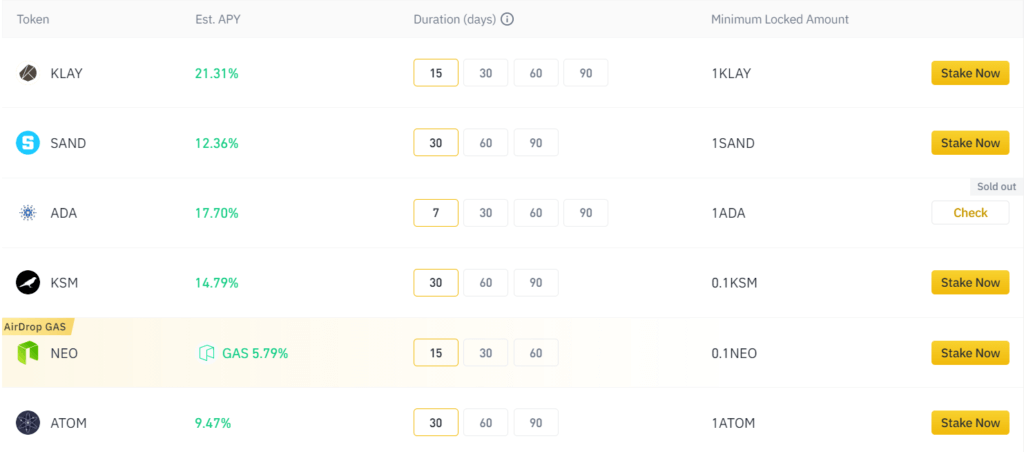

Staking tokens is a way for crypto holders to earn passive income essentially by pledging their tokens to validate transactions on blockchain networks. Tons of exchanges offer such options. Staking Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), etc. can earn good APY (Annual Percentage Yield).

Staking can be in terms of Locked staking, Defi staking, etc. Each has its terms, locking period, flexible period, and different returns.

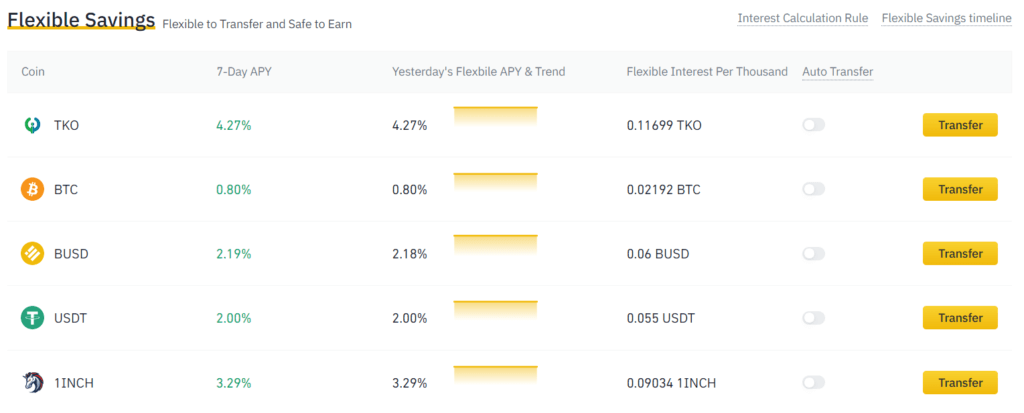

Savings

Savings may provide you lesser returns and acts as a form of a normal bank savings accounts. But, again it is always advisable that your money makes money rather than sitting idle. It is locked as well as flexible saving options.

Liquid Swap

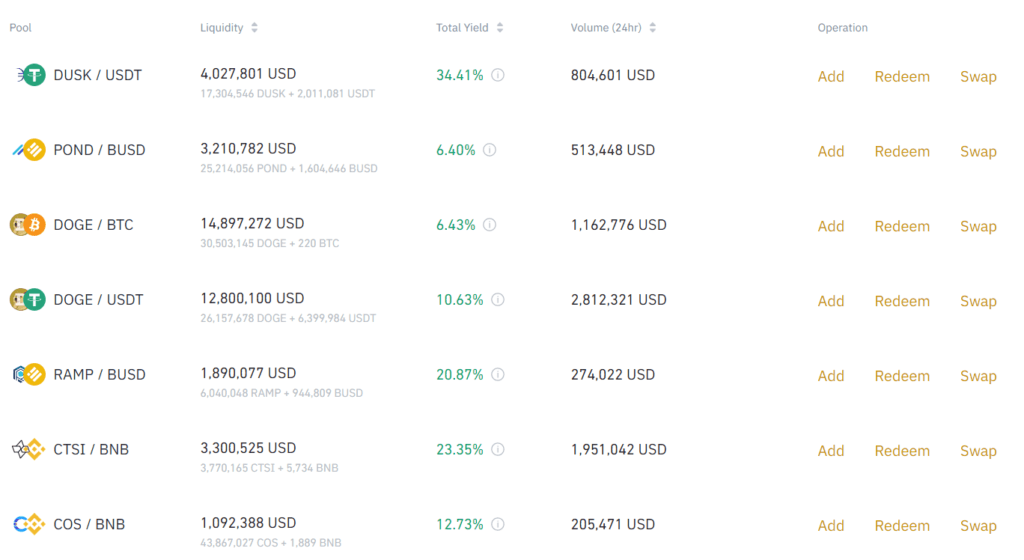

As per the term itself reveals Liquid swap acts as a way of providing liquidity. Liquid swap can be used by Crytpo holders to earn income by investing Single or Dual coins.

Other ways

Cryptocurrency has just started its reach globally and there are a ton of ways to earn passive income. Above listed ones are quite safe as per my personal tried and tested experience. You can also check out various other ways like lending services, dividend tokens, etc.

The above-listed way provides a way of generating income at the same time beating inflation. At the time when the value of Master currency USD is falling and there is no better return on investments, Crypto has always beaten the trend. Normal Fixed deposits, Recurring deposits will fetch you 5-6% and even with a year-long or more of investment. But, Crypto not only generates income in native token it makes sure the income itself is gaining its value.

Interest or APY is credited to your wallet in the same token/coins. For e,g. If you stake 1 Bitcoin or 0.01 Bitcoin, the returns will be in Bitcoin. The same applies to other currencies as well.

Note – I wouldn’t suggest you put all your money in crypto but, seeing the trend a normal investor can earn handsome returns unless you have good money to invest in Real Estate or other such investments that requires huge capital. Stock Market and Cryptocurrencies are some of the ways to beat Inflation and these have proven pandemic ready instruments.

Last piece of investment can be small but depends on your appetite would be cryptocurrency Mining:

How to start Cryptocurrency Mining, basic guide

All the options apart from Mining I listed are based on my personal tried and tested experience. Also, there are a ton of Crypto exchanges that can give more returns.

If you are planning to start investing do check out Binance and WazirX. Check our Cryptocurrency tab for more related stories. Follow us on Facebook & Twitter.